Blogs

Understanding ESOPs – Register to our FREE webinar!

Understanding ESOPs – Register to our FREE webinar!

Blogs

Fear of mortality. There. I said it. Yes, I’ve discovered the number one reason why small business owners avoid planning to leave their business behind – either to a family member or selling it. We don’t want to face being on the last few of the last nine holes of a career we spent years building. But like Forrest Gump so bluntly stated – it happens.

What are the risks of not planning for the transition or sale of your business?

I’ve spent much of my career helping businesses plan for a successful exit – from my years as a financial consultant with Dorman & Farrell and now as president of Succession Plus US. It always makes me sad when business owners and entrepreneurs don’t want to have the conversation about an exit strategy. They’ve taken tremendous risks to build their business — yet won’t fulfill their most important fiduciary responsibility to themselves, their family, their employees and community by planning for a successful transition of their business.

I’ve found that business owners will have a serious discussion about business transition decisions – if they feel safe and comfortable. Maybe that’s on a golf course or maybe it’s in a boardroom or even at a local wine bar. It doesn’t matter where. What matters is a business owner being willing to “drop the gloves” of the competitive, protective mindset that has maybe led to success in business – but kept them from looking further down the road.

If you’re a baby boomer business owner, you’re not alone. You’re one of 12 million businesses in the same position. In the next 10-years, it’s estimated that 70% of those businesses will be sold. So – beware. Supply will likely outweigh demand – and your business could be overlooked and undervalued. Without a plan for retirement and the transition of your business, you put yourself and your family at risk.

You’re savvy about knowing and beating the competition. Why not do the same with your exit strategy? You’re up against 12 million other baby boomer business owners. Don’t you want to get ahead of this “silver tsunami” and be better prepared than the next guy?

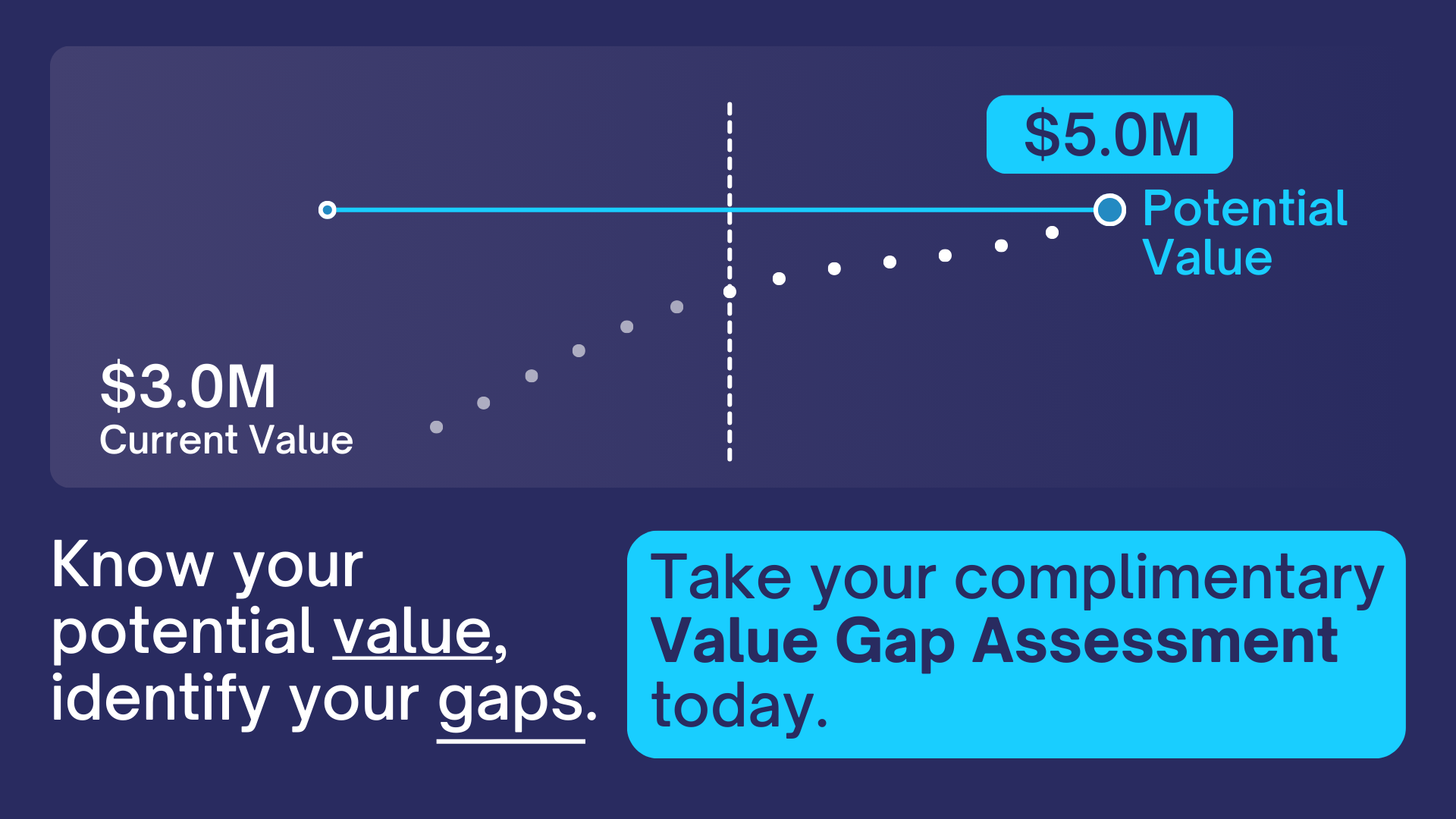

A good place to start is by asking “what is the value of my business?” Less than 2% of business owners know the value of their business. And only 13% of business owners have an exit and succession plan.

Our team at Succession Plus US has worked with hundreds of businesses like yours. We take that first step for you – by running a preliminary valuation of your business. Once you know that, shouldn’t you plan to protect that $3 million or that $100 million-dollar asset – whatever value your business may be?

The next step is to develop a plan to monetize the value of your business — so you can live off it, generate income, and leave that value to your spouse, your children and your community.

Transition planning takes a village. That’s why we work with you and your village – including your accountant and attorney. We’ve learned that small businesses need a full-service firm devoted to helping you “set the table and serve it up.” We draw out your objectives, understand the current state of your business, and assess how much retirement income you’ll need. Then we integrate all that with input from your attorney and accountant.

So many of our clients are surprised by what happens when they have those strategic conversations and create a transition plan for the future. It ends up making their business more valuable now – because they focus on building that value throughout the planning process.

They make the business less about them and more about practices and procedures that allow the business to thrive when they aren’t in the room. They get a better sense for how they’ll generate retirement income. And they walk away with tremendous peace of mind, knowing they have a plan in place to take care of themselves, their family and their employees. They’re set – to enjoy the next chapter in life. And those last nine holes.

Succession planning expert Bo Burlingham, author of the book Finish Big, says it best: “The worst thing that can happen when you work with an exit planning advisor is that your business will be better because of it.”Baby boomer business owners — are you ready to talk? We’re ready to listen. We’re ready to help.

Mark Dorman

2 min read

2 min read

Sep 3, 2024 | Blogs

Unlocking Business Potential: Accelerate Your Business Value with the Value Gap Assessment Tool

1 min read

1 min read

Jul 17, 2024 | Blogs

The Five Levels of the Business Planning Pyramid

1 min read

1 min read

May 21, 2024 | Blogs

Planning for the 5 Ds: Essential Strategies to Safeguard Your Business

1 min read

1 min read

Apr 9, 2024 | Blogs

Get Smart: How to Reward and Retain Key Employees