Small Business CGT Concessions

For many small business owners, the major source of retirement funding is the sale of their business or assets owned by the business. Fortunately, there are a number of capital gains tax (CGT) concessions available to small business that reduce or even eliminate the capital gain on the disposal of certain assets.

It’s important to understand the concessions available and the eligibility requirements to ensure entitlements are maximised. In this article, we review the eligibility criteria required to qualify for the small business CGT exemptions and examine in detail how these concessions can most effectively be applied.

Types of concessions

There are four main small business CGT concessions:

- 15-year exemption;

- 50 per cent active asset reduction;

- Retirement exemption; and

- Rollover exemption.

In addition, where the taxpayer is an individual, a partner in a partnership or a trust, they may also be entitled to the general 50 percent discount that applies to assets held longer than 12 months. This is a compulsory concession and must be applied before any of the remaining small business concessions.

Eligibility criteria

To be eligible for the CGT concessions available to small businesses on disposal of an asset, the following eligibility conditions need to be met:

- Satisfy the net asset value test or small business entity test;

- Meet the active asset test;

- Where the asset is shares in a company, or units in a trust:

– The taxpayer claiming the concession is a CGT concession stakeholder in the company or trust; or

– If the disposing entity is a company or trust, CGT concession stakeholders in the company or trust have a small business participation percentage in the interposed entity of at least 90 per cent.

If these initial conditions are met, the disposing entity must then meet additional eligibility conditions that apply respectively to each of the four small business concessions:

- 15-year exemption;

- 50 per cent active asset reduction;

- Retirement exemption; and

- Rollover exemption.

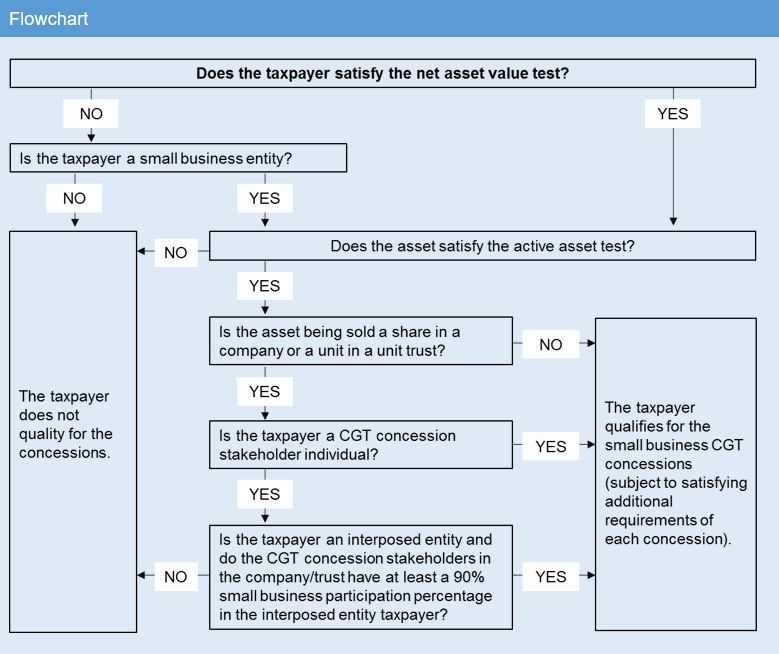

The flowchart illustrates how taxpayers navigate through the initial set of basic conditions.

The net asset value test

The test requires the total net asset value (NAV) of CGT assets (less excluded assets) owned by the following entities to be no more than $6 million just before the CGT event occurs:

- The taxpayer;

- Entities connected with the taxpayer;

- Small business CGT affiliates of the taxpayer, or of entities connected with small business CGT affiliates of the taxpayer.

Where a partnership exists, and the taxpayer is a partner, the NAV test only counts the assets of each relevant partner, not the partnership as a whole.

In calculating the NAV of the CGT assets, most liabilities of the entity related to the assets are deducted. Certain provisions, such as provisions for annual leave, can also reduce the NAV.

Excluded CGT assets

Table 1 shows the key assets that are excluded from the Net Asset Value test.

Small business entity test or turnover test

The small business entity (SBE) test is used to determine whether an entity is a small business entity. To be considered a small business, the taxpayer must be carrying on a business and have an aggregated turnover of less than $2 million.

Access to the concessions by way of the turnover test also extends to:

- Taxpayers who are not carrying on a business but who own a CGT asset that is used in the business of an affiliate or entity connected with the asset owner;

- Partners who own a CGT asset (that is not an interest in a partnership asset) used in the partnership business.

Aggregated turnover

Aggregated turnover is the annual turnover of the taxpayer and any other entity that is connected with the taxpayer or which the taxpayer has influence over. Generally, aggregated turnover is calculated by looking at the turnover of the previous income year. If it was less than $2 million, then the taxpayer is a small business entity.

Calculating aggregated turnover

Annual turnover includes all gross income earned in the ordinary course of business in the income year. Where a business starts or ceases partway through an income year, a reasonable estimate of what would have been earned had the business operated for the full income year is required.

The aggregated turnover test is relatively simple where the taxpayer has no connected or affiliated entities. However, where such entities exist, calculating aggregated turnover can be much more complex.

Active asset test

The active asset test requires that the asset being disposed of is an active asset for a specific period of time as follows:

- if the asset was owned for 15 years or less, the asset was an active asset for a total of at least half the relevant period;

- if the asset was owned for more than 15 years, the asset was an active asset for at least 7.5 years during the relevant period.

The relevant period starts on the acquisition date of the asset and ends on the earlier of the CGT event and the day the business ceases if it is ceased within 12 months before the CGT event.

There is no requirement for the asset to be an active asset for a continuous period nor does the asset have to be active at the time of disposal. Therefore, any periods that the asset is an active asset can be aggregated to determine if the test is met.

CGT concession stakeholder test

Where the assets being sold are shares in a company or units in a trust, an additional condition needs to be met depending on whether the disposing entity is an individual or a company/trust.

If the taxpayer is an individual, then they will qualify if they are a CGT concession stakeholder in the company or trust in which the taxpayer holds the shares or units.

If the taxpayer is a company or trust, it must satisfy the 90 per cent test. The entity satisfies the 90 per cent test if 90 per cent of the small business participation percentages in that entity are held by CGT concession stakeholders of the company or trust in which the shares or interests are held.

CGT concession stakeholders

An individual is a CGT concession stakeholder of a company or trust if they are a significant individual or the spouse of a significant individual where the spouse has a small business participation percentage in the company or trust at that time that is greater than zero.

Significant individuals

An individual is a significant individual in a company or trust if they have a small business participation percentage in the company or trust of at least 20 per cent. The 20 per cent can be made up of direct and indirect percentages.

Small business participation percentage

The small business participation percentage of an individual is the sum of the individual’s direct and indirect small business participation percentage in the other entity at that time.

Companies

An entity’s direct small business participation percentage in a company is the percentage of:

- Voting power that the entity is entitled to exercise;

- Any dividend payment that the entity is entitled to receive;

- Any capital distribution that the entity is entitled to receive.

If an entity has different participation percentages in a company, their participation percentage is the smaller or smallest percentage.

Trusts

For trusts where entities have entitlements to all of the income and capital of the trust, the direct small business participation percentage of an entity is the smallest of their percentage of the following:

- The income of the trust that the entity is beneficially entitled to receive; or

- The capital of the trust that the entity is beneficially entitled to receive.

For trusts where entities do not have entitlements to all of the income and capital of the trust, and the trust makes an income or capital distribution, the direct small business participation percentage of an individual is the smallest of their percentage of the following:

- Distributions of income that the entity is beneficially entitled to during the income year; or

- Distributions of capital that the entity is beneficially entitled to during the income year.

Where there is no income or capital distribution in an income year, then no significant individual exists.

Case study 1

Angus is 59 with no spouse or dependants and owns a successful computer business. Angus purchased the business in 2005 for $450,000. Since then it has turned into a highly successful business, which he would like to sell for $1.95 million.

Angus intends to retire permanently from the workforce after the sale.

His personal assets are as follows in Table 2. Table 3 outlines determining the eligibility for small business concessions, and Table 4 refers to applying the CGT concessions to calculate the net gain.

As Angus is over age 55, he has two options for the part of the proceeds representing the CGT retirement exemption:

As Angus is over age 55, he has two options for the part of the proceeds representing the CGT retirement exemption:

- Contribute the amount to super; or

- Take it as a cash lump sum.

If the business had been set up as a company, partnership or trust, the concessions may still be available, although his retirement and the final result may differ.

Case study 2

Brad and Kim are a married couple in their late 30s and own a hairdressing salon called BradKat Pty Ltd.

They are the only shareholders in the business, which they have owned for 10 years. Brad owns 80 per cent and Kim owns the remaining 20 per cent. Brad plans to work for another 10 years while Kim wishes to sell her share of the business.

Brad has offered to buy out Kim’s share of the salon.

The current value of the business is as follows:

- Salon worth $1 million (originally purchased for $500,000 with investment capital);

- Goodwill worth $100,000 (no cost base);

- Cash account $200,000 (not an active asset).

The couple’s only other asset is their Central Park residence worth $10 million, which is held in joint names.

Kim will sell her shares to Brad for $260,000, being 20 per cent of the company’s market value. The accrued capital gain is $160,000 (Kim’s base cost being 20 per cent of the investment capital of $500,000 = $100,000).

Kim would like to minimise her capital gains tax position on the sale of her shares in the business.

Does Kim satisfy the basic conditions?

Under the small business CGT concessions, Kim satisfies the maximum net asset test. The value of her joint share in the Central Park home is excluded under the test. Kim includes the total net market value of the salon (not just her share), as she and Brad are classed as small business CGT affiliates. This connects her to the business. The business does not exceed the $6 million threshold.

Kim’s shares are active assets (assets have been owned for 15 years or less and the asset was an active asset for a total of at least half of the test period).

Kim must be either a significant individual of the business or spouse of a significant individual (where the spouse has a small business percentage in the company or trust that is greater than zero) in order to be a CGT concession stakeholder and therefore able to access the concessions.

- Kim is a significant individual, as she has a small business participation percentage of at least 20 per cent and therefore is a CGT concession stakeholder.

- Kim’s shares in the salon just prior to the CGT event are considered active assets if the market value of the active assets of thebusiness pass the 80 per cent test.

Refer to Table 5.

Kim meets all of the requirements set out under the basic conditions.

Which small business CGT concession can Kim access to minimise her tax liability?

Kim has not held her shares for longer than 15 years, so she does not qualify for the 15-year retirement exemption (even if they were held for 15 years, Kim would not qualify, as she has not retired after her preservation age or due to permanent incapacity). Kim is not interested in the small business rollover concession, as she does not wish to start another business.

Fortunately, Kim is eligible for the following small business concessions:

- Small business 50 per cent reduction – the basic conditions have been satisfied;

- CGT retirement exemption – 100 per cent exemption up to $500,000 lifetime limit (election must be made in writing with the CGT exempt amount paid to a complying superannuation fund, as she is under preservation age).

How should Kim structure the concessions?

Kim is also eligible for the 50 per cent individual CGT discount.

Kim will first reduce her $160,000 capital gain by the individual 50 per cent reduction. The remaining capital gain of $80,000 may be further reduced as outlined in Table 6.

Option 1 is a more favourable option, as it results in Kim only having to roll over $40,000 into superannuation (compared to $80,000 under Option 2). If Kim wishes to increase her superannuation balance, she could make a non-concessional contribution into superannuation from part or all of the balance of the $260,000 proceeds from the sale.