Understanding, co-ordinating and preparing the three key factors of Business Succession and Exit Planning is critical to developing a successful plan.

These key factors are as below:

1.The Business

Unfortunately, although they may be good businesses, the large majority of companies are not exit or sale ready. Instead, a large proportion are owner dependent and often lack effective systems and processes – these issues can limit the value of the business and impact the business’ ‘sellability’. While the business in question may be quite large, some of them run as though they are much smaller.

2. The Owner/s

Owning a company is an important part of an owner’s life, that’s why many business owners are very strongly attached to their business. A business owner will identify with the business in what is called role-identity fusion and will need time and space to get comfortable about what the exit actually looks like and importantly what does life after business mean.

3.The Money

The business, the owner/s and their finances are often complicated and interwoven and therefore hard to separate. The Exit Planning Institute estimates that up to 90% of an owners wealth is tied up in and linked to the business – this needs to be resolved before an exit can take place and to make sure the owner and their family is adequately funded post retirement.

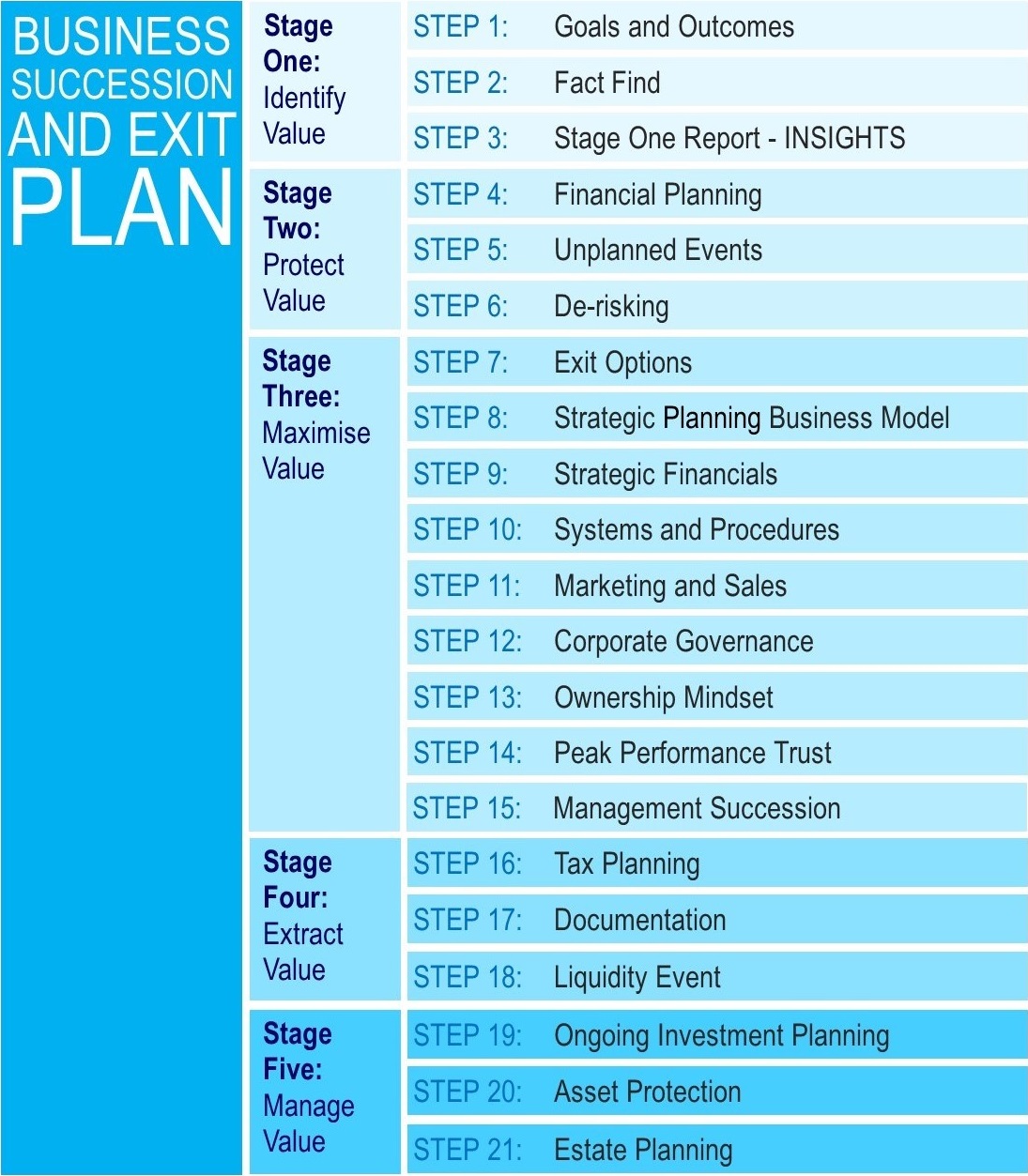

Value-focused five-stage process

We use and recommend a five-stage process – all focused around value.

-

Identify

-

Protect

-

Maximise

-

Extract

-

Manage

All of these stages have a number of key steps – 21 in all. These are designed to effectively prepare the business, the owner and the financial position to maximise business value and achieve a successful exit.

This process has been developed over time – when I first published Enjoy It in 2006 our process had only 9 steps, which mainly focused on preparing the business. As we worked with clients and learned more about their needs and the issues that were stopping them from being successful the process was further developed into 11, then 15 and finally 21 steps.

The process now covers all of the key issues – business, personal and financial to ensure maximum success.

21-Step Process

The process allows time and space for owners to get very clear on what Business Succession and Exit Planning means to them – for many it is not about the money, but more about preserving their legacy, looking after staff, customers and suppliers, and the process needs to firstly identify the key drivers and aspirations of the founders and secondly, provide a mechanism for them to be successful in achieving those key goals and outcomes.

To fully implement the 21 steps we typically work with clients over a 12 -18 month period (and with some clients much longer) and we always find work closely with the clients key advisers – accountant, financial planner, lawyers, bankers etc. will help speed the process and ensure the best possible result. This is very much a trusted adviser relationship and we work closely with the owners, family members, key employees and other stakeholders to balance interest and ensure all Business Succession and Exit planning needs are met.

Become an Accredited Adviser

As an Accredited Adviser, Succession Plus’ proprietary 21-Step process allows you to strategically guide your clients through a successful exit so they can achieve the most profitable, optimal outcome.

To find out more about our 21-step process or to express your interest in becoming an Accredited Adviser, please feel free to contact us. To read more about the key benefits of being an Accredited Adviser, click here.