Succession Planning

Understanding ESOPs – Register to our FREE webinar!

Understanding ESOPs – Register to our FREE webinar!

Succession Planning

Selecting the most appropriate exit strategy for you and your business will greatly impact the outcome for the owners, the business moving forward, and other stakeholders. There are two main types of exit strategies for your company:

Financial Harvest: This group of exit strategies is designed to maximise value and ensure the owners extract maximum financial value (harvest) for the business when they exit. Whilst they bring in higher prices, they are more complicated, take longer, are riskier, and success can rely heavily on market conditions.

Legacy Stewardship: These exit strategies are focused on ensuring the business’s success after the exit and that other stakeholders—employees, customers, suppliers, and family members—are “looked after” as part of a successful exit strategy.

Importantly, there are a small number of strategies that can deliver both outcomes, and these are becoming popular exit strategies. Hybrid exits where both financial outcomes and legacy-type results are popular with owners and other stakeholders.

Get your FREE copy of It All Begins with Insights by Dr Craig West, CPA – to better understand what your private business is worth, what exit options are available, and what needs to be done to identify, protect, maximise, and extract its maximum value.

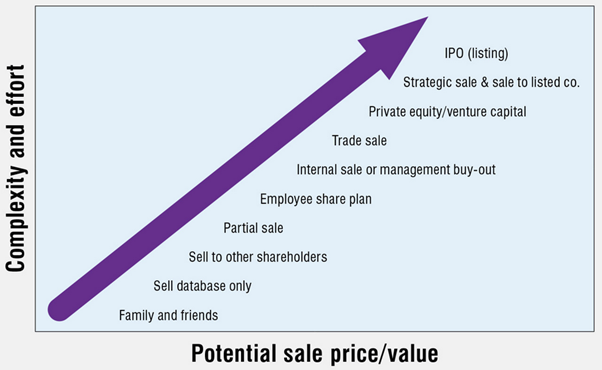

If you’re exploring a range of business exit strategies, the diagram below highlights the most common options used. The choice of business exit strategy is personal and influenced by multiple factors. Some owners are looking for a financial harvest (top right quarter), and others are looking for a legacy exit strategy (bottom left). In the centre of the diagram, those are a combination or hybrid business exit strategy.

Initial public offering (IPO) – an initial public offering or listing on a public exchange, is normally the highest-order exit strategy available – but it is unsuitable for most SMEs lacking the size and scale to list publicly. While it might achieve the highest price, it is also risky and expensive.

Strategic Buyers – and sale to a listed company. There is a substantial difference between strategic and financial buyers. For many, finding a strategic buyer is the best exit strategy – it is certainly likely to yield a strong financial harvest – becoming a strategic acquisition target company and attracting a strategic buyer takes time and effort but will produce a higher price than a financial buyer. If the acquiring company is listed this will also help to increase the multiple paid.

Private Equity and Venture Capital – Attracting a venture capitalist or private equity investment are often a growth strategy but often leads to an exit by the founder. Using external funding to make acquisitions as part of a roll-up strategy to buy other businesses as part of the exit strategy lets the business achieve scale – and size does matter. The owners typically remain involved initially but use the funding to drive growth and increase value prior to approaching a strategic buyer.

Trade Sale – Selling the business to a competitor or related business is often called a trade sale and is a popular exit strategy. Because the buyer is often in a related industry and/or local, this normally leads to a smooth transition, and the business normally continues after the sale. If both parties have realistic expectations, then this exit option can meet business goals and is often less time-consuming in terms of a successful transition to the new owner.

Management Buyouts – such as selling the business to existing employees and the management teams, are often an easy option as the management team understands the business and how to manage it successfully. The team is normally already involved in executing the business plan. Also, it has existing relationships with customers, suppliers, and other employees – a management buyout is also less risky in terms of transition.

Employee Share Ownership Plan – Employee ownership is becoming more popular as a business exit strategy, mainly because it is seen as a hybrid exit strategy – a combination of financial harvest and legacy. Business owners can achieve a balance of both, and selling the company this way is often part of a longer-term succession plan. Selling the business to employees often preserves the current culture and values of the business, and many employees are attracted to owning a share of a small business.

Partial Sale – selling down a percentage of the business as part of an exit strategy can reward existing partners and also be used to identify future potential buyers. This also helps to protect the current business operations and may also inject capital to fund future growth.

Sell to other shareholders – selling some or all shares to other existing shareholders is often a less risky strategy for key stakeholders. If owners are of varying ages, this might be part of an ongoing succession strategy – similar to the old partnership-type models in professional services firms. In the same way as when a company’s management team purchases the business, the continuity of leadership reduces risk with this exit strategy.

Sell database or list – This business exit strategy is one of a group of different business exit strategies because we are not really transferring the business but merely selling off one of the business assets. This exit plan means the business no longer operates but is really not a great way to maximise value or likely to bring in as much money.

Family succession – Often discussed, this is one of the more common exit strategies, which involves family members taking over from the existing business owner (normally a family member). This exit strategy takes time and often depends upon family ability, funding and willingness to take over. Family succession can also be complicated as family are often involved in multiple roles within the company – employee, shareholder, family member, etc.

Liquidation is normally the result of financial distress, having business assets seized or even a bankruptcy filing. It is typical of failing businesses and does not normally produce any financial outcome for the business owner. Liquidation involves selling business assets.

Importantly, several business exit strategies might be employed for the right company to get an even better result. Owners might sell down to the management team, bring in private equity to fund other acquisitions and growth and then exit to a strategic buyer or initial public offering IPO.

Many factors will influence your business exit strategy, and it is a personal decision for business owners. Having an exit plan is the first priority, as a well-thought-out exit strategy will always be more successful. Whether you are looking at initial public offerings, passing the business to a family member or anything in between, having a good exit strategy should be a key focus area for business owners, boards and advisers.

In most cases (as with any strategy), a good exit strategy takes time – in most cases, three to five years. Identifying strategic buyers, timing of market conditions, reaching our profit objectives, and ensuring our financial records are up to date will all help your company sell. Managing business cash flow and driving a substantial profit will help valuation, but just as importantly, proving the business does not depend upon you and has a good team of people with a good understanding of the business will also improve the asking price.

Implementing all of these improvements will take time (remembering that someone has to run the business in the meantime). Whilst this is time-consuming and can require investment, the ROI will be large. Attracting your target buyer and being on top of market trends when you sell will normally attract the right money. Having a solid plan for your company, including a realistic exit strategy, should be part of your business plan. Whilst many owners are looking for a clean break, most also hope the business continues after the exit event.

Business owners must set realistic expectations, and often, the most popular exit strategy is not the right choice for your business. To better understand the options available and look at detailed insights in the same way a financial buyer will do, you should always start with a business valuation – we use a Business Insights Report. This takes into account market conditions, the investment required to increase value and the key areas to focus on (some are counter intuitive) for your company.

Get your FREE copy of ‘It All Begins with Insights’ by Dr Craig West, CPA to further explore the exit options available, and what needs to be done to identify, protect, maximise, and extract its maximum value.

Dr Craig West

2 min read

2 min read

Oct 16, 2025 | Resources Succession Planning

Pathway Options for Business Owners: Choosing the Right Exit Route

.webp) 2 min read

2 min read

Oct 14, 2025 | Resources Succession Planning

Sale Readiness Legal Checklist for Advisers

.webp) 2 min read

2 min read

Oct 2, 2025 | Selling Your Business Succession Planning

Succession, Price & Probability: Making the Most of Today’s M&A Market

.webp) 2 min read

2 min read

Sep 17, 2025 | Succession Planning

Succession, Badly Done: Lessons from Australia’s Wealthiest Families