Employee Ownership

Understanding ESOPs – Register to our FREE webinar!

Understanding ESOPs – Register to our FREE webinar!

Employee Ownership

Issuing shares in a private company is a popular way for businesses to raise funds or reward investors and employees. However, the process can be complex, especially for those who are new to it. In this article, we will explore how to issue shares in a private company in Australia and the rules and regulations that need to be followed. We will also discuss share gifting, which is a way of giving private company shares as a gift..

The process of issuing shares in a private company in Australia involves several steps. Here are the key points to keep in mind:

Employers are allowed to give $1,000 worth of shares to employees who earn less than $180,000 annually, without any taxation effect for either the employee or the employer. Although it is a good start, it is often not enough to attract and retain employees.

On the other hand, employees can contribute up to $5,000 per annum to an employee share plan pretax, similar to a salary sacrifice contribution to a superannuation fund. This is a more meaningful benefit, allowing employees to acquire shares in a tax-effective way. The previous government looked at increasing this limit, but this has not been confirmed yet.

If shares are sold to employees instead of gifted, the rules are strict on the conditions under which the shares can be sold. For instance, if a share is worth $100, it can be sold to an employee with a discount of up to 15%, which is $85 (but not less than that) to the market value of the shares. It is important to note that any discount will eventually be considered taxable income to the employee, although this can be deferred for up to 15 years under the current rules.

Dr Craig West

1 min read

1 min read

Oct 29, 2025 | Employee Ownership Business Value Acceleration

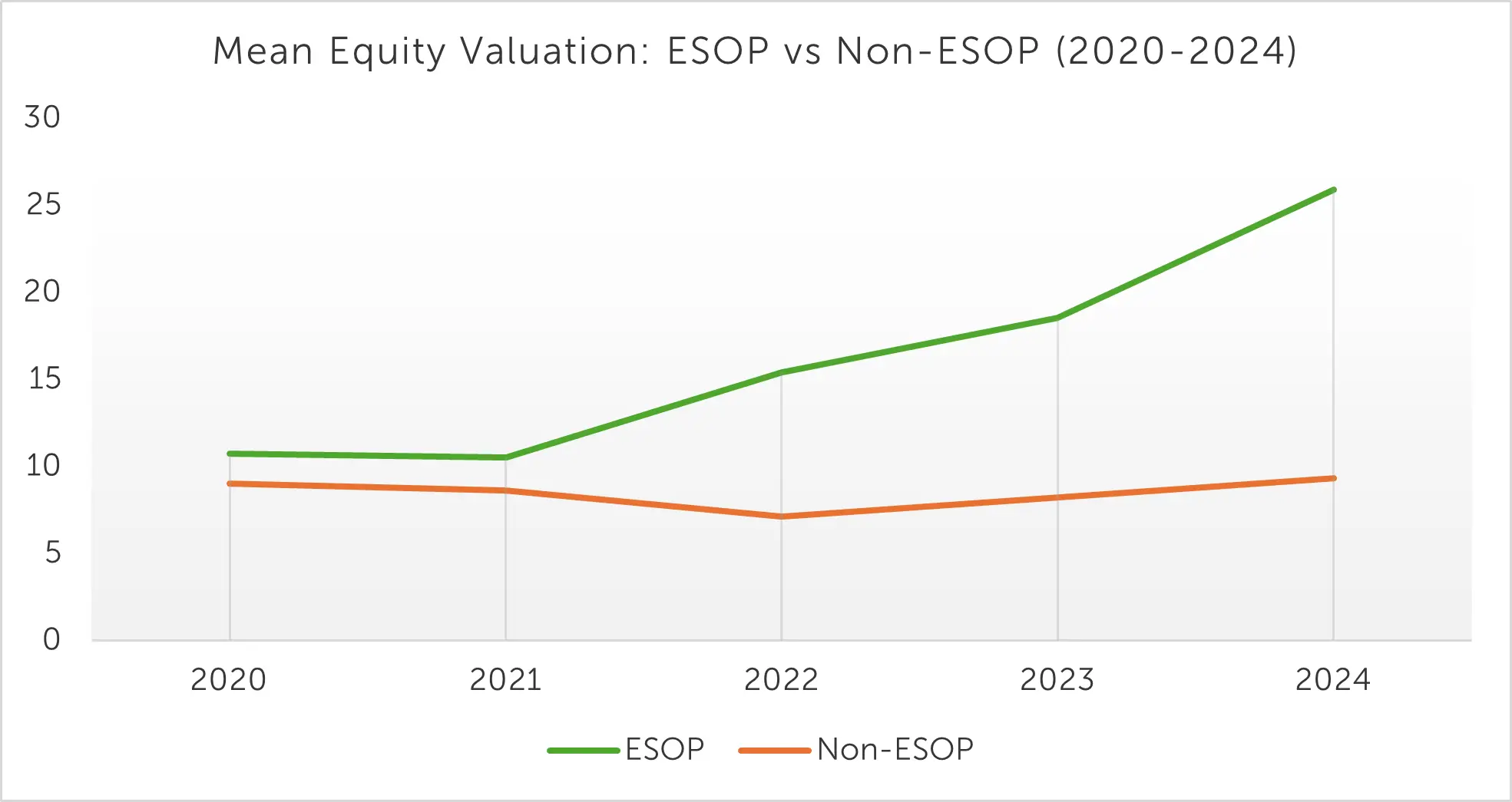

The Value of Ownership: ESOP Companies Achieve Strong Equity Growth

.webp) 2 min read

2 min read

Sep 26, 2025 | Employee Ownership Business Value Acceleration

OwnerShift+™: Build Culture & Accelerate Business Value

3 min read

3 min read

Sep 8, 2025 | Employee Ownership Succession Planning Business Value Acceleration

The 3x3 Framework | Business Growth & Succession Insights

3 min read

3 min read

Aug 25, 2025 | Employee Ownership Business Value Acceleration

Smart ESOP Strategies Before Selling Your Busines