What is Capital Gains Tax?

Capital Gains Tax (CGT) is the amount of income tax you pay on any capital gain you make during the financial year. Therefore, CGT is not a separate tax, rather, any Capital Gain you make is included in your assessable income and is taxed at the applicable marginal rate.

You will only pay CGT if a CGT event occurs and consequently a Capital Gain is made. Most CGT events involve the disposal of a CGT asset, which include: land, buildings, shares in a company, units in a unit trust, contractual rights, foreign currency, licenses and goodwill.

If the cost base of your asset is less than the amount you receive as a result of the CGT event, then a Capital Gain has been made. If the cost base is greater than the amount you receive, a Capital Loss has occurred. The cost base includes costs associated with the CGT event, these include:

- acquisition costs

- incidental costs

- ownership costs

- any costs incurred with the intention of increasing the assets value

- any costs incurred to establish, preserve or defend the title or right to the asset

I’m selling my business. Can I reduce the amount of CGT I have to pay?

There are four Small Business CGT concessions that can reduce the amount of CGT payable if you satisfy the basic conditions outlined in the Income Tax Assessment Act. In short, there are three areas you need to satisfy in order to be considered eligible for the concessions.

You must first satisfy one of the following criteria:

- Your business is considered a small business entity. Meaning that you are an individual, partnership, company or trust that is carrying on a business and has an aggregated turnover of less than $2 million.

- small business entity that is connected/affiliated with you.

- You are a part of a partnership that is for all purposes considered a small business entity, and the CGT asset is a partnership asset or is used in the business.

- Neither you, nor any of your affiliates can have a net value of assets greater than $6 million.

The CGT asset must pass the “Active Asset Test”, meaning:

- You have owned the asset for 15 years or less, and said asset has been an active asset of yours for at least half of the ‘test period’; or

- You have owned the asset for more than 15 years and it was considered an active asset for at least 7.5 years during the “test period”.

If the CGT asset is a share in a company or interest in a trust, then one of the following criteria must be satisfied:

- You must be a CGT concession stakeholder in the company/trust.

- You, and other CGT concession stakeholders must have a participation percentage in the company of at least 90%.

The small business 15-year exemption

If you’ve owned your business continuously for 15 years or more, are 55+ years old and are retiring, or permanently incapacitated, then you may be eligible for this exemption and pay ZERO CGT on any capital gains from the sale of your business.

If you’re eligible to apply, further conditions need to be satisfied. These being:

- Whoever is making the payment must do so within 2 years of the CGT event;

- The payment made must be to an individual who was a CGT concession stakeholder of the company or trust just before the sale; and

- The total payments to each CGT concession stakeholder cannot exceed an amount equal to:

- CGT concession stakeholder’s control percentage multiplied by the exempt amount.

Any amounts from the 15-year exemption contributed to your superannuation will generally be considered a non-concessional contribution. If you want to exclude the amount from the non-concessional contributions cap, you can put a maximum of 1.315 million towards your superannuation CGT cap instead.

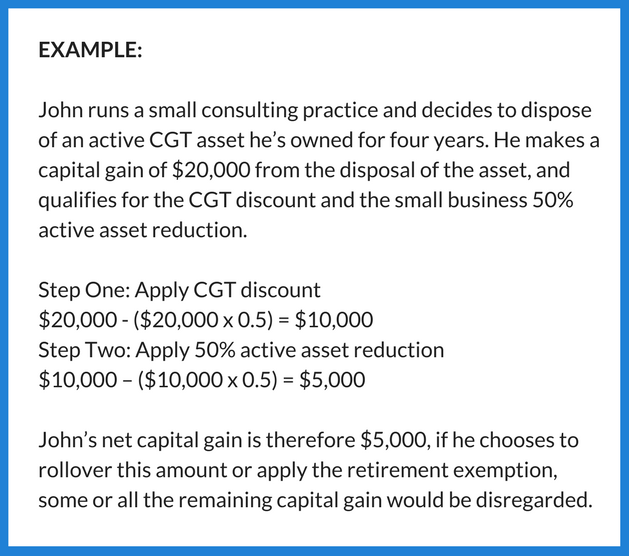

The small business 50% active asset reduction

To qualify for the Small Business 50% Active Asset Reduction, you only need to satisfy the basic conditions outlined earlier in the article. This reduction applies automatically, unless you decide you do not want it to apply.

You can also apply other small business concessions to the remaining CGT amount after the 50% reduction, or apply for both the 50% reductions and the CGT discount to effectively reduce CGT by 75%.

There are separate rules outlined for beneficiaries of trusts and fixed trusts’ distributions, which are outlined in Subdivision 115-C of the Income Tax Assessment Act of 1997.

Small business retirement exemption

The requirements you need to satisfy to get the Small Business Retirement Exemption differ for individuals, and companies and trusts. If you qualify you can choose to disregard all or part of your Capital Gain.

If you are applying for the exemption as an individual, you must satisfy the following:

- You must satisfy the basic conditions (found on page one of this article);

- Keep a written record of the chosen amount you wish to disregard – the CGT exempt amount;

- If you are under 55 before you choose to use this exemption, you must make a personal contribution equal to the exempt amount to your superannuation.

You must then make the contribution:

- When you made the choice to use the retirement exemption, or when you received the proceeds (whichever is later); or

- If the relevant event is a CGT event J2, J5, or J6, when you made the choice to use the retirement exemption.

If you are applying for the exemption as a company or trust, you can still choose to disregard part or all of the Capital Gain, however you must meet the following criteria:

- You must satisfy the basic conditions.

- You must satisfy the significant individual test.

- You must keep a record of the amount you choose to disregard. (Note that if there is more than one CGT concession stakeholder, each stakeholders’ percentage of the exemption amount must be noted).

- You must make a payment to at least one of the CGT concession stakeholders (worked out by reference to each individual’s percentage of the exempt amount).

You must then make the contribution:

- Seven days after you choose to disregard the Capital Gain, if you choose the retirement exemption for a J2, J5, or J6 event.

- For any other CGT events, the payment must be made 7 days after you choose to disregard the gain, or seven days after you receive the capital proceeds (whichever occurs later).

You can choose to apply the small business retirement exemption after or instead of the Small Business 50% Active Asset Reduction, and where you choose to rollover your Capital Gain under certain provisions of Income Tax Assessment Action 1997.

Any amounts from this exemption contributed to super will have the same consequences as amounts from the 15-year exemption.

Small business rollover

If you are eligible for the Small Business Rollover, you can choose to rollover the capital gain and it will not be included in your assessable income.

To be considered eligible for the Small Business Rollover, you need to satisfy the basic conditions that are required for all small business concessions. You can still qualify for the rollover, even if you have not yet obtained a replacement asset, or incurred expenditure on a capital improvement to an existing asset. However, acquiring an active replacement asset is crucial for obtaining the rollover.

You can choose to rollover as much of the capital gain as you want either after the Small Business 50% Active Asset Reduction, or instead of the 50% Active Asset Reduction. Both options have their advantages and disadvantages.

This article provides a brief outline of the Small Business CGT Concessions that could be available to you. However, it is important to seek professional advice and start planning early to ensure you can maximise value and reduce the amount of CGT payable.

Looking to sell your business?

Download our guide on 15 tips for maximising business value.