Your guide to making your business more valuable.

The Business Insights Report has been specifically designed after many years of experience in valuing businesses and assisting business owners to maximise the value of their business and achieve a successful exit. The report provides an overall insight score, which is a combination of ratings made up of financial, non financial, exit and sale readiness, ESG, and credit and benchmarking comparisons.

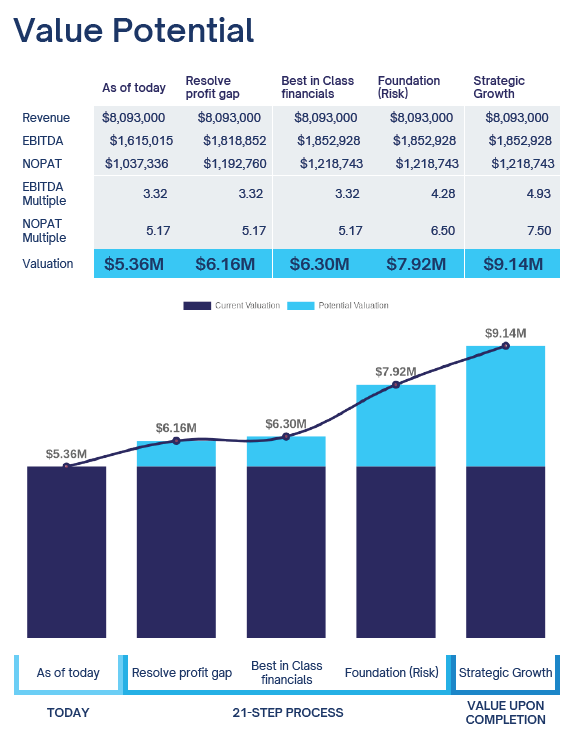

Ultimately, the report provides a valuation which is a number telling you exactly what the business is worth today. More importantly, though, it provides a value table, a view of the key drivers and the key issues, risks and gaps that have been identified as part of the process where you can improve the value of your business. Where those gaps are closed, where those issues are addressed, where those value drivers are focused on, we can increase the value of the business over time, and the value table maps out exactly what increase can be made depending on which activities are undertaken and completed.

Ultimately, the report provides a valuation which is a number telling you exactly what the business is worth today. More importantly, though, it provides a value table, a view of the key drivers and the key issues, risks and gaps that have been identified as part of the process where you can improve the value of your business. Where those gaps are closed, where those issues are addressed, where those value drivers are focused on, we can increase the value of the business over time, and the value table maps out exactly what increase can be made depending on which activities are undertaken and completed.

The report provides a detailed implementation plan based on our unique 21-Step Business Succession and Exit Planning process developed and refined over 14 years after working with over 800 clients. The 21 Steps include over 150 business tools (checklists, templates, processes and documents), which are customised to deliver results in reducing risk, filling identified gaps and improving performance.

As part of the overall process, when certified by the adviser, each and every tool and step that is implemented within the business improve value, reduces risk, improves profitability and/or financial performance, and ultimately improves the value of the business. The report identifies more than 150 different metrics, financial, non-financial, risk and benchmarking that guide the business owner in exactly the right steps to take to improve the value of the business, and importantly, which ones are going to make the most difference: which risks are extreme or urgent, which need to be prioritised and resolved as quickly as possible to minimise risk and protect the value of the business; and then, which steps, tools and processes should be implemented over a period of time, which levers to pull to change the value of the business fundamentally. Over a 12 to 18-month period, it’s not unusual to see the value of the business increased by 20%, 30% and even 40% or 50%. But you have to know where to start.

The Business Insights Report gives you the tools you need and the implementation plan that goes with it to prioritise those actions and identify which ones are most importantly going to drive your valuation higher over a period of time. The Business Insights Report is also becoming the benchmark for comparing mid-market businesses. If your business performs well financially but has some risks and nonfinancial issues, then the report will help identify those so they can be rectified. Banks and other lenders can look at the report and get a very clear view of where your business is at and where it’s heading and what you’re doing as an owner to start to address the issues.

If you’re looking at selling or raising capital or investment or even debt, then the report can be used as a guideline for those people to come in, look at your business with an independent review and get some clarity and comfort around exactly what they’re investing in, lending to or buying. Ultimately, every business should have a Business Insights Report and it should be reviewed regularly, and the actions recommended implemented to help you as a business owner maximise the value of your business and achieve a successful exit.

Looking to sell your business?

Download our guide on 15 tips for maximising business value.