Over the last 20-30 years, we have seen a wealth eroding trend in investments (and as a result amongst business owners). Our news cycle has shortened dramatically, so has our attention span and in my view so has our investment horizon.

We regularly see CEOs of public companies “hammered” after poor quarterly results (in the same way sports coaches are sacked after six bad games in a row). There is a whole school of entrepreneurship that teaches “fail fast”, and the government has invested substantial $$$ in start-ups and focuses very little attention on “boring” mid-market businesses that have been around for 20 years.

I read an interesting article a few weeks ago, courtesy of Isaac Pino CPA, that goes to the very heart of this issue, about the investment time frames of Warren Buffett, the world’s most successful investor.

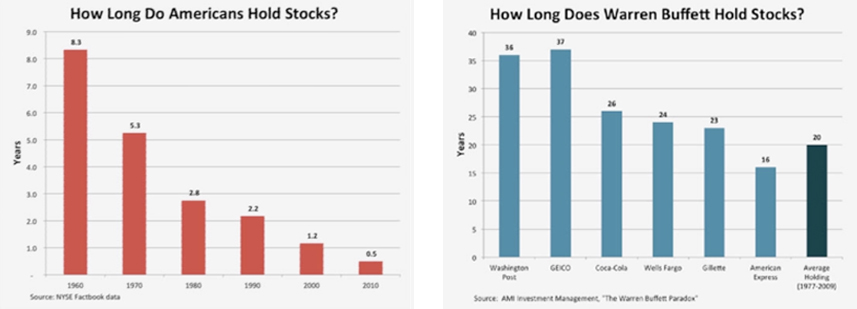

It drew a straightforward comparison between the “average” investment holding period for American investors (6 months down from 8.3 years in 1960) and the average holding period for Warren Buffett (20 years – with some investments held for more than 40 years).

Which also reminds me of a quote I often refer to in presentations: “The proper man understands equity – the small man, profits.” – Confucius, 551 – 479 BC

Imagine the value business owners could create if they had a time horizon for their business of 20 years or longer.

In “The Essays of Warren Buffett: Lessons for Corporate America” Buffett says: Just run your business as if:

1. you own 100% of it,

2. it is the only asset in the world that you and your family have or will ever have; and

3. you can’t sell or merge it for at least a century.”

Buffett’s third point is especially relevant, as it indirectly touches on a critical issue plaguing global economies: public companies, beholden to their shareholders, focus far too much on short-term prospects and quarterly earnings.

In his “simple mission,” the Buffett argues that businesses should abandon that type of short-term thinking and instead focus on the long-term outlook.

If your entire focus was on what the business would look like on 2037 how differently would you think, act and plan? What strategies would you put in place with 2037 as the target?

"What makes sense in business also makes sense in stocks: An investor should ordinarily hold a small piece of an outstanding business with the same tenacity that an owner would exhibit if he owned all of that business."

Warren Buffett, 1993 Click to TweetInterested in offering staff a stake in your business?

Get your free ESS guide.