Employee Ownership

Understanding ESOPs – Register to our FREE webinar!

Understanding ESOPs – Register to our FREE webinar!

Employee Ownership

Standard option plan (market value exercise price options) taxed on income account and targeted at the tax deferral concession (for employees holding 10% or less).

The plan can be drafted so that the options constitute “indeterminate rights” so that employees holding more than 10% can obtain tax deferral.

Standard performance rights plan taxed on income account and targeted at the tax deferral concession (for employees holding 10% or less).

The plan can be drafted so that the performance rights constitute “indeterminate rights” so that employees holding more than 10% can obtain tax deferral.

Standard option plan that qualifies for the start-up concession. The start-up concession allows for capital account treatment (with potential access to the 50% CGT discount concession) and tax deferral through to disposal of the shares received on exercise of the options.

The plan allows for employees to nominate an entity (such as a family discretionary trust) to hold the options which provides additional tax advantages.

A share plan that allows for up to $1,000 of shares to be provided to certain employees (those with an adjusted taxable income of $180,000 or less) each year without tax being payable.

A loan plan involves the company making a limited recourse loan to an employee to enable the employee to buy shares in the company at market value.

There is no cash outflow from the company – the loan funds circle back to the company by way of subscription price for the shares.

The loan is generally interest-free and repayment of the principal may be funded partly or wholly through dividends paid by the company.

There are generally forfeiture conditions (such as cessation of employment within a particular time frame) which, if triggered, entitle the company to buyback the shares at their issue price.

A loan plan can be structured to have a similar economic effect to a grant of options (with a market value exercise price).

The benefit of a loan plan is that any gains on the shares are taxed on capital account (with potential access to the 50% CGT discount concession).

Loan plans (and associated documentation) need to be drafted carefully to ensure there are no adverse FBT or Division 7A implications.

A standard option plan but with the exercise price of the options set at a premium to the current market value/price of a share.

If the exercise price is set at a sufficient premium to the current market value/price of a share, the options will have a nil value under the employee share scheme tax tables which means they will be taxed under the capital gains tax regime (with potential access to the 50% CGT discount concession) rather than on income account under the employee share scheme regime (Division 83A).

In terms of the premium required to produce a nil value, a premium of 100% will always produce a nil value, no matter the length of the exercise period. The shorter the exercise period, the lower the premium needs to be to produce a nil value.

The setting of the exercise price at a premium will diminish the returns to the employee. Therefore, premium-priced options tend to only be used by high-growth companies.

A flowering share plan involves the issue of a special class of shares to employees where certain rights attaching to the shares (such as voting rights and dividends rights etc) are “turned off” until the vesting conditions are met. Once the vesting conditions are met, the shares “flower” in the sense that the rights which were previously “turned off” come into existence.

Flowering shares are structured so that their value is nominal. The employee then pays that nominal market value for the shares meaning that the employee share scheme tax regime does not apply. The employee is taxed under the capital gains tax provisions (with potential access to the 50% CGT discount concession). If necessary, a loan can be provided by the company to the employee to enable the employee to purchase the shares – see the section above on loan plans).

Flowering share plans are complicated. As a result, they are generally only used for senior management. They are commonly used by private equity to incentives founders (and other key management) in investee companies who hold more than 10% of the shares in the company and therefore cannot access employee share scheme tax concessions (e.g. the start-up concession or tax deferral).

It is possible to incorporate a number of the above plans into an “omnibus plan”.

Image credit to https://careeremployer.com/

Dr Craig West

1 min read

1 min read

Oct 29, 2025 | Employee Ownership Business Value Acceleration

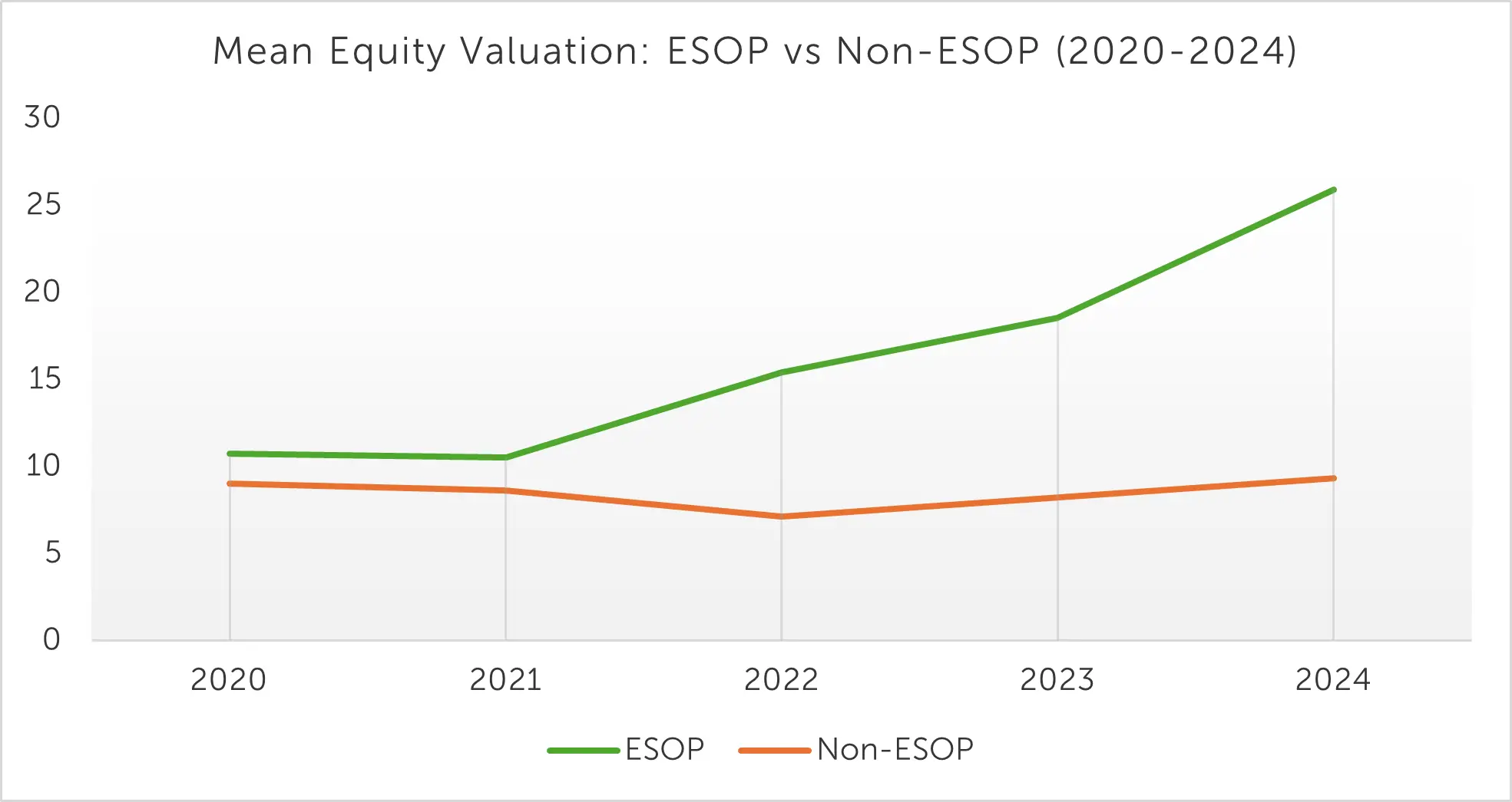

The Value of Ownership: ESOP Companies Achieve Strong Equity Growth

2 min read

2 min read

Sep 26, 2025 | Employee Ownership Business Value Acceleration

OwnerShift+™: Build Culture. Earn the Mark. Accelerate Value.

3 min read

3 min read

Sep 8, 2025 | Employee Ownership Succession Planning Business Value Acceleration

A Practical Guide to KPIs for Professional Services: The 3×3 Framework

3 min read

3 min read

Aug 25, 2025 | Employee Ownership Business Value Acceleration

Why an ESOP Is a Smart Move Before Selling Your Business